BOE PUBLICATION GENERAL STATE BUDGETS 2023. LABOR ASPECTS

Law 31/2022, of December 23, on General State Budgets for the year 2023, which will enter into force on January 1, was published in the Official State Gazette number 308 .

In the labor and social field, we highlight the following aspects:

In Title I:

- Chapter III, «Social Security» regulates the financing of health care provided by the Institute of Health Management, non-contributory health care of the Social Institute of the Navy, as well as the financing of IMSERSO. Likewise, all transfers made from the State to Social Security are included.

In Title II:

- In Chapter II of Title II of the Budget Law relating to the «Budgetary Management of Social Security, Health and Social Services», specific powers are collected in terms of budgetary modifications of the National Institute of Social Security, of the General Treasury of Social Security, the Social Institute of the Navy, the Social Security IT Management, the National Institute of Health Management and the Institute for the Elderly and Social Services and includes regulations on the application of remnants of treasury in the budget of the Institute for the Elderly and Social Services. (Articles 15,16 and 17).

Title IV:

Under the heading «Of public pensions», it is divided into six chapters.

- Amount of retirement and disability pensions of the Social Security system in its non-contributory modality: It will increase by a percentage equal to the average value of the interannual variation rates expressed as a percentage of the Consumer Price Index for the twelve months prior to December 2022. (art. 44).

- Supplement for non-contributory pensions: 525.00 euros/year (art. 44)

Amount of the pensions of the extinguished Mandatory Old Age and Disability Insurance (not concurrent with other public pensions): 6,280.00 euros (art. 45) - Minimum supplements: in accordance with the provisions of article 27 of the consolidated text of the State Passive Class Law, State Passive Class pensioners who do not receive, during 2023, income from work, capital or economic activities and capital gains, in accordance with the concept established for said income in the Personal Income Tax, or that, received, does not exceed the amount resulting from applying to the amount provided for in the first paragraph of section one of article 43 of Law 22/2021 of December 28, on General State Budgets for the year 2022, the percentage increase equal to the average value of the interannual variation rates expressed as percent of the Consumer Price Index for the twelve months prior to December 2022.

- Social Security family benefits and contributory pension supplement to reduce the gender gap (DA 36):

1. The amount of the economic allocation established in art. 353.1 of the LGSS in the case of a child under eighteen years of age or a dependent minor with a degree of disability equal to or greater than 33 percent will be calculated annually at 1,000 euros.

2. The amount of the economic allowance established in article 353.2 of the LGSS for cases of dependent children over eighteen years of age, with a degree of disability equal to or greater than 75 percent and that, as a consequence of anatomical or functional, need the assistance of another person to perform the most essential acts of life, such as dressing, moving, eating or similar, will be in its annual calculation the amount resulting from applying to the amount provided in the fourth paragraph of section one of the thirty-ninth additional provision of Law 22/2021 of December 28, on the General State Budget for the year 2022, the percentage increase equal to the average value of the interannual variation rates expressed as a percentage of the Consumer Price Index of the twelve months prior to December 2022.

3. The amount of the benefit for the birth or adoption of a child established in art. 358.1 of the LGSS , in cases of large, single-parent families and in the cases of mothers or fathers with disabilities, it will be 1,000 euros.

4. The amount of the economic allocation and the annual income limit for beneficiaries who, in accordance with the sixth transitional provision of Law 19/2021, of December 20, which establishes the minimum vital income, maintain or recover the right to economic allowance for each child under eighteen years of age or dependent minor without disability or with disability of less than 33 percent, will be in their annual calculation:

– The amount of the economic allocation will be 588 euros/year.

– The income limits to receive the economic allocation are set at the amount resulting from applying to 12,193.00 euros per year, the percentage increase equal to the average value of the interannual variation rates expressed as a percentage of the Consumer Price Index of the twelve months prior to December 2022 and, in the case of large families, in the amount resulting from applying to 19,434.00 the percentage increase equal to the average value of the interannual variation rates expressed as a percentage of the Price Index at the Consumption of the twelve months prior to December 2022, increasing by the amount resulting from applying to 3,148.00 the percentage increase equal to the average value of the interannual variation rates expressed as a percentage of the Consumer Price Index for the twelve months prior to December 2022 for each dependent child from the fourth, this included.

However, the amount of the economic allocation will be, in annual calculation, the amount resulting from applying to 588.00 euros the percentage increase equal to the average value of the interannual variation rates expressed as a percentage of the Consumer Price Index of the twelve months prior to December 2022 in cases where family income is less than the amounts indicated in the table included in section one of the thirty-ninth additional provision of Law 22/2021 of December 28, on General State Budgets for the year 2022, increased by a percentage equal to the average value of the interannual variation rates expressed as a percentage of the Consumer Price Index for the twelve months prior to December 2022.

5. Pension supplement to reduce the gap : It is established in the amount resulting from applying to 28 euros per month, the percentage increase equal to the average value of the interannual variation rates expressed as a percentage of the Consumer Price Index of the twelve months prior to December 2022.

Title VIII

Under the heading «Social Contributions», the regulations relating to the bases and types of contribution of the different Social Security schemes, proceeding to update them.

The Title consists of three relative articles, respectively:

- «Bases and types of contribution to Social Security, Unemployment, Protection for cessation of activity, Wage Guarantee Fund and Vocational Training during the year 2023»,

- «Contribution to the General Employee Mutual Societies for the year 2023» and

- «Quotation of passive rights».

regime :

- The maximum limit of the contribution base in each of the Social Security schemes that have it established, is set, as of January 1, 2023 at: 4,495.50 euros per month.

- The minimum ceiling, unless otherwise expressly provided, is set at the amounts of the interprofessional minimum wage in force at any given time, increased by one sixth.

- Quote types:

– For common contingencies, 28.30 percent, with 23.60 percent being the responsibility of the company and 4.70 percent being the responsibility of the worker.

– For the contingencies of accidents at work and occupational diseases, the percentages of the premium rate included in the fourth additional provision of Law 42/2006, of December 28, on General State Budgets for the year 2007 will be applied, being the resulting premiums exclusively paid by the company

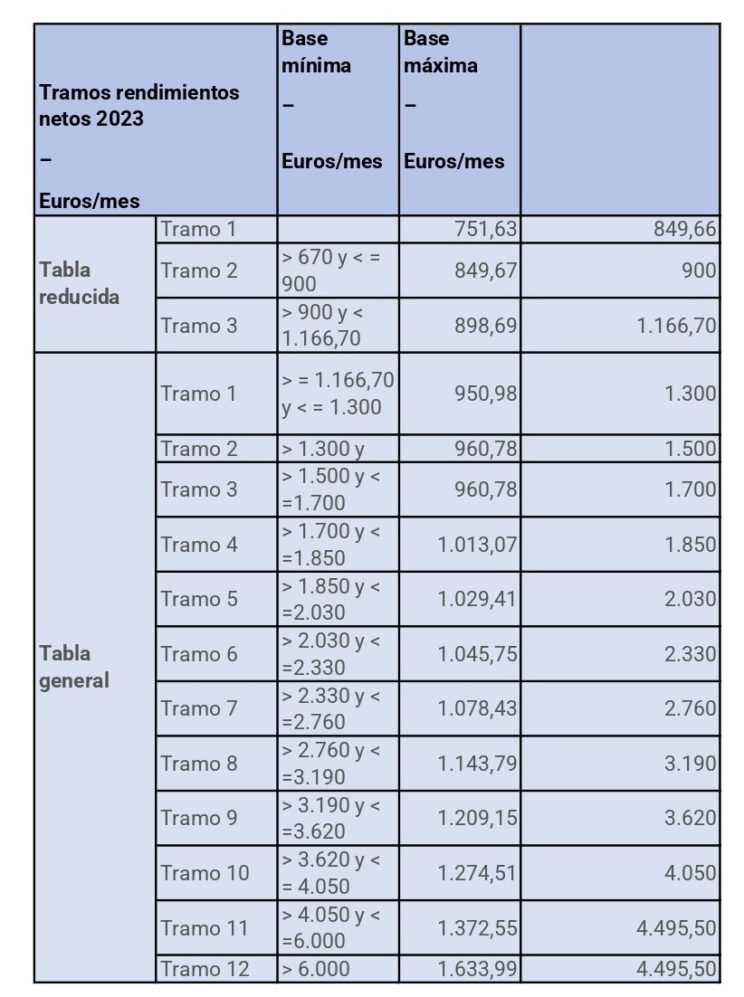

Self- employed regime (RETA):

- The maximum contribution base, regardless of the net income obtained by self-employed or self-employed workers, will be 4,495.50 euros per month.

- During the year 2023, the general table and the reduced table, and the maximum and minimum bases applicable to the different sections of net income, will be the following:

- The contribution base of workers who as of December 31, 2022 have requested a change in their contribution base with effect from January 2023 will be the one requested as long as they are in one of the sections of the tables in section 2, and meet the provisions of Royal Decree-Law 13/2022, of July 26, which establishes a new contribution system for self-employed or self-employed workers and improves protection for cessation of activity. Those workers who have requested the automatic update of their contribution base as of January 2023 will be that of December 31, 2022 increased by 8.6 percent provided they are in one of the sections of the tables in section 2. , and comply with the provisions of Royal Decree-Law 13/2022, of July 26, which establishes a new contribution system for self-employed or self-employed workers and improves protection for cessation of activity. Workers who have not exercised any of the above options will maintain, as of January 2023, the contribution base for which they had been contributing in 2022, provided that this is equal to or higher than the one that would correspond to them by application of those established in the Royal Decree-Law 13/2022, of July 26, which establishes a new contribution system for self-employed or self-employed workers and improves protection for cessation of activity.

- The relatives of the self- employed worker included in this special regime, may not choose a monthly contribution base of less than 1,000 euros during the year 2023, in accordance with the provisions of the seventh transitory provision of Royal Decree-Law 13/2022, of 26 July.

- Self-employed workers who as of December 31, 2022 were contributing for a contribution base higher than the one that would correspond to them due to their income, may maintain said contribution base during the year 2023, or a lower one, even if their income determines the application of a contribution base lower than any of them, in accordance with the provisions of the sixth transitional provision of Royal Decree-Law 13/2022, of July 26.

- The contribution rates as of January 1, 2023:

1. For common contingencies, 28.30 percent when the temporary disability is covered by another Social Security scheme and the self-employed worker does not choose to voluntarily take advantage of the coverage of this benefit, a reduction will be applied in the quota that It would be appropriate to enter in accordance with the reduction coefficient established by the order that develops the legal regulations for Social Security contributions, Unemployment, Protection due to cessation of activity, Salary Guarantee Fund and Vocational Training for the year 2023.

2. For professional contingencies, 1.30 percent, of which 0.66 percent corresponds to the contingency of temporary disability and 0.64 to those of permanent disability and death and survival.

3. Those self-employed workers excluded from contributing due to professional contingencies must contribute at a rate of 0.10.

- Self-employed workers in a multi-activity regime , and do so during the year 2023, taking into account both the contributions made in this special regime and the company contributions and those corresponding to the worker in the Social Security regime that corresponds to their activity as an employee , will be entitled to a 50 percent refund of the excess in which their contributions for common contingencies exceed the amount of 15,266.72 euros with a ceiling of 50 percent of the contributions entered into this special regime due to their contribution for common contingencies . In such cases, the General Treasury of the Social Security will proceed to pay the reimbursement that corresponds in each case, within a maximum period of four months, except when there are specialties in the contribution that prevent it from being made within that period or it is necessary to provide data. by the interested party, in which case the refund will be made after the same.

- In accordance with the provisions of the second additional provision of Royal Decree-Law 13/2022, of July 26, the contribution based on the income from economic or professional activity will not apply to members of institutes of consecrated life of the Catholic Church. They will choose their monthly contribution base in an amount equal to or greater than the minimum base of section 3 of the reduced table of contribution bases. The monthly contribution bases chosen by them will not be subject to regularization, as they are not quoted based on income . Likewise, the coverage of the contingency for temporary disability, the contingencies of work accident and occupational disease, due to termination of employment, will not be required. activity and professional training.

- The self-employed workers dedicated to street vending (CNAE 4781 Retail trade of food, beverages and tobacco products in stalls and markets; 4782 Retail trade of textile products, clothing and footwear in stalls and markets and 4789 Retail trade of other products in stalls and markets) may choose to quote for a base equivalent to 77% of the minimum base of section 1 of the reduced table, the same will apply to worker members of associated work cooperatives dedicated to street vending who receive their income directly from buyers.

- The worker members of associated work cooperatives dedicated to street vending that have been included in the RETA, will be entitled, during 2023, to a 50 percent reduction in the fee to enter. The worker members of associated work cooperatives dedicated to street vending that have started their activity and have been included in the aforementioned special regime as of January 1, 2009 will also be entitled to this reduction. The reduction will be applied to the quota that results to apply on the minimum base chosen, the type of contribution in force in the Special Regime for Self-Employed or Self-Employed Workers.

- The 25th Final Provision states that the amount of the unemployment benefit from day 181 increases to 60% of the regulatory base (until 12/31/2022 it was 50%).

«2. The amount of the benefit will be determined by applying the following percentages to the regulatory base: 70 percent during the first one hundred and eighty days and 60 percent from day one hundred and eighty-one.» - The percentages will also apply to those who, at the entry into force of this law, were receiving the unemployment benefit.

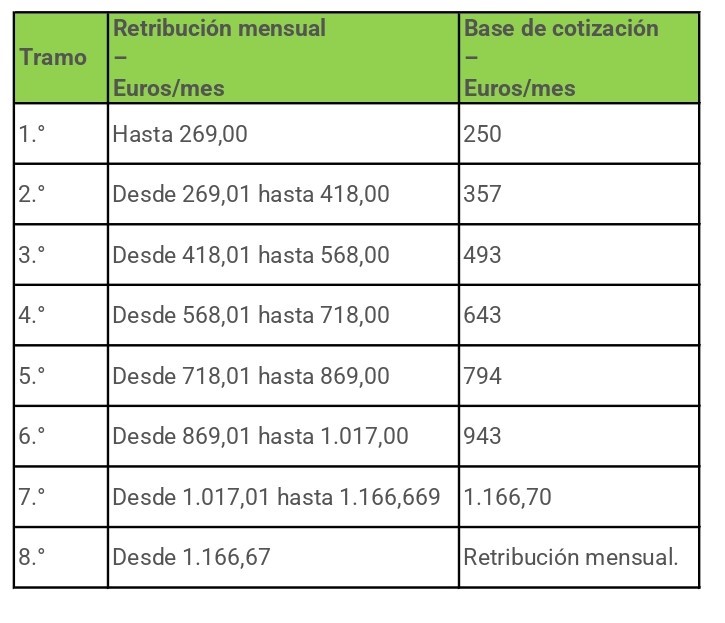

Domestic workers regime

The contributions to domestic employees would be:

- The contribution rate for common contingencies will be 28.30 percent, with 23.60 percent being paid by the employer and 4.70 percent by the employee.

- For the contribution for contingencies of accidents at work and occupational diseases, based on the corresponding contribution, the type of contribution established for this purpose in the premium rate included in the fourth additional provision of Law 42/2006, of December 28, the result being the sole responsibility of the employer.

- During the year 2023, a 20 percent reduction in the business contribution to the Social Security contribution will be applicable for common contingencies in this special system. The beneficiaries of this reduction will be the people who have hired or hired, under any contractual modality, and registered in the General Social Security Regime a worker in the service of the home. Likewise, they will be entitled to a bonus of 80 percent in business contributions to the unemployment contribution and to the salary guarantee fund in that special system.

- As an alternative to the reduction, employers who register a domestic worker in the General Social Security Regime, as of April 1, 2023, will have the right, throughout the registration situation in said regime , to a bonus of 45 percent or 30 percent in the business contribution to the Social Security contribution for common contingencies corresponding to the Special System for Household Employees established therein, when they meet the equity and/or income requirements of the family or cohabitation unit of the employer under the terms and conditions established by law. These bonuses will only be applicable with respect to a single household employee registered in the General Social Security Scheme for each employer. If there is more than one household employee registered in said Scheme for each employer, the bonus will be applicable only to the person who is registered in the first place.

- A 45 percent bonus will be applied to the Social Security contributions paid by the employer for large families.

IPREM 2023 (Additional Provision 90)

The public indicator of multiple effects income (IPREM) for 2023 will have the following amounts:

- The daily IPREM: 20 euros.

- The monthly IPREM: 600 euros.

- The annual IPREM : 7,200 euros.

- In the cases in which the reference to the minimum interprofessional salary has been replaced by the reference to the IPREM in application of the provisions of Royal Decree-Law 3/2004, of June 25 , the annual amount of the IPREM will be 8,400 euros when the corresponding norms refer to the interprofessional minimum salary in annual computation, unless they expressly exclude extraordinary payments; in this case, the amount will be 7,200 euros.

Financing of professional training for employment (Additional Provision 92)

The companies that are listed for the professional training contingency will have a credit for the training of their workers depending on the size of the companies:

- Companies with 6 to 9 workers: 100 percent.

- From 10 to 49 workers: 75 percent.

- From 50 to 249 workers: 60 percent.

- Of 250 or more workers: 50 percent.

- Companies with 1 to 5 workers will have a bonus credit per company of 420 euros, instead of a percentage.

- The companies that open new work centers during the year 2023, as well as the newly created companies, when they incorporate new workers to their staff, will have a bonus credit whose amount will result from applying the amount of 65 to the number of newly incorporated workers. euro.

- Companies that train people affected by temporary employment regulation files regulated in article 47 of the Workers’ Statute or by one of the modalities of the RED Mechanism will be entitled to an increase in credit for the financing of actions in the field of programmed training of the amount indicated in said section, depending on the size of the company.

- Companies that grant individual training permits to their workers in 2023 will have a bonus credit for training in addition to the annual credit that may not exceed 5 percent of the credit established in the budget of the State Public Employment Service for financing. of bonuses in Social Security contributions for professional training for employment.

Suspension of the contribution reduction system for professional contingencies due to a decrease in occupational accidents (Additional Provision 97)

This suspension will be extended until its regulation by RD resumes.

CONTACT INFO

Or fill this form and we will get in touch with you.