Income derived from the rental of urban real estate (rental of a home)

Self-assessment to be entered made by a taxpayer who obtains income derived from the lease of urban properties located in Spanish territory

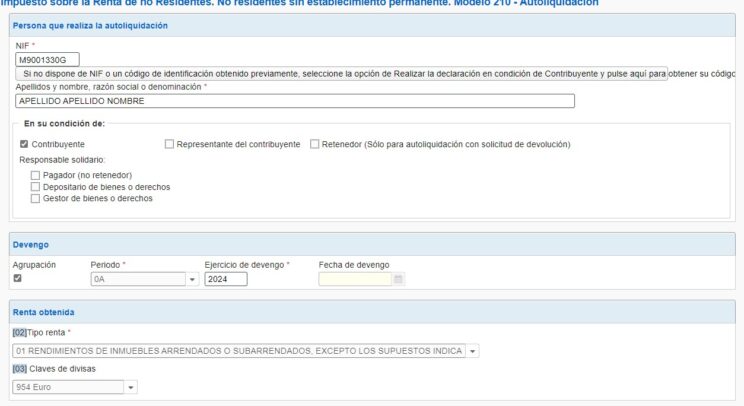

To carry out the self-assessment and payment, you must present the form 210 of the Non-Resident Income Tax (IRNR) declaration.

To do this, you must access the Electronic Headquarters of the Tax Agency and by completing the pre-declaration form, a PDF will be generated with form 210 and some instructions.

For income accrued since 2024, you can choose to group annually (the quarterly grouping option disappears) the returns (as long as certain requirements are met) in a single self-assessment or submit a self-assessment for each income accrual.

Income grouping

income obtained by the same taxpayer may be grouped together provided that it originates from the same payer, is subject to the same tax rate, and originates from the same property (declaring Income type: 01). However, in the case of income from leased properties not subject to withholding, rental income that comes from several payers may be grouped together as long as the same type of tax is applicable and comes from the same property (in this case, recording as Type of income: 35 and leaving the form data relating to the payer unfilled).

If you choose to group annually, the presentation and payment deadline will be the first twenty calendar days of the month of January of the year following the year of accrual. For example, if you meet the grouping requirements and choose to annually group the income accrued in the year 2024, the deadline for submitting and entering form 210 will be the first twenty days of January 2025. If you wish to direct the payment, the deadline for electronic submission will be from January 1 to 15.

If you choose to declare each income accrual separately, the deadline for presentation and payment of form 210 will be the first twenty calendar days of the months of April, July, October and January, in relation to income whose accrual date falls within the calendar quarter. For example, if the rental amount is received monthly, you will have to submit three 210 forms and enter the corresponding amount, in relation to the income accrued from January to March, within the period from April 1 to April 20, 2024. If you wish to direct the payment, the deadlines for electronic submission of self-assessments form 210 are as follows: from April 1 to 15, July, October or January.

Regarding the forms of presentation and payment, you can consult the following link: Forms of presentation and payment of model 210 .

From December 16, 2023 (date of entry into force of Order HFP/1338/2023, of December 13), this self-assessment can only be carried out by the taxpayer.

If you do not have a NIF (Tax Identification Number) assigned in Spain, at the beginning of completing the pre-declaration form, after checking the “S Taxpayer” box, there is the option to request at that same moment an Identification Code that will be It will be used both to complete this model 210 and for other subsequent ones.

Example: Leasing of urban real estate. Physical person. Income accrued during the year 2024

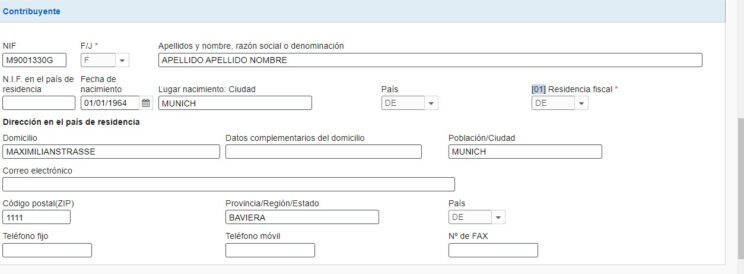

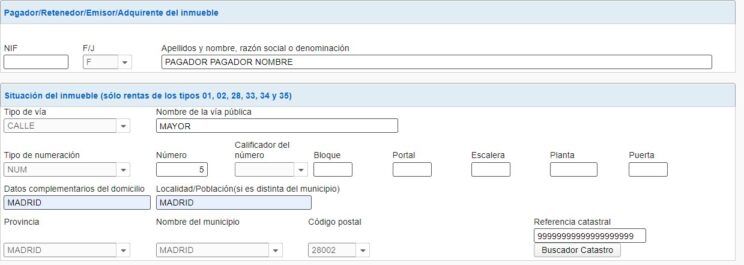

A natural person (NAME SURNAME SURNAME), with tax residence in Germany, has obtained monthly in Spain, during the year 2024, 1,000 euros in income derived from the rental of a home, located at Calle Mayor nº 5 in Madrid, accrued on 5th day of each month.

The taxpayer chooses to declare the income grouped (annually). The income corresponds to the same payer (Type of income: 01).In preparing the example, the possible expenses necessary to obtain returns have not been taken into account.(1).

Accrual

Group: X

Period/year: 0A

Accrual exercise: 2024

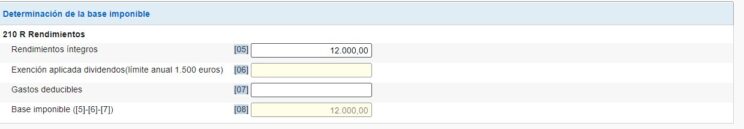

Calculation of the taxable base

210 R Performance

Full returns: 12,000.00 euros (1,000 x 12 months)

Deductible expenses: 0 euros

Taxable base: 12,000.00 = 12,000.00 euros

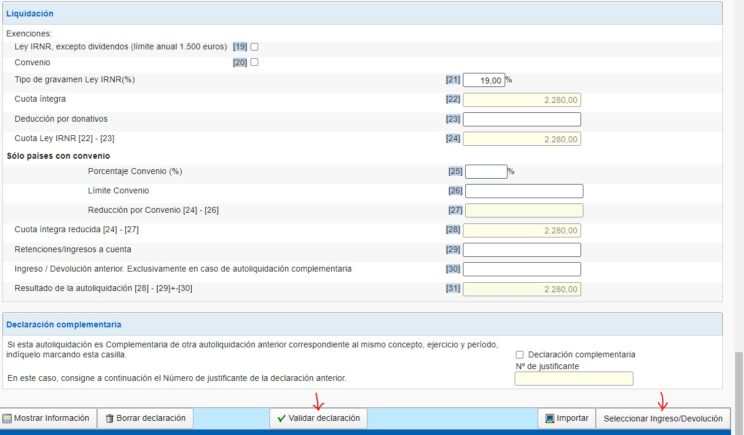

Settlement

Tax type IRNR Law in 2019: 19%(2)

Full fee (19.00% of 12,000.00): 2,280.00 euros

IRNR Law Fee: 2,280.00 euros

Reduced full fee: 2,280.00 euros

Result of the self-assessment to be entered: 2,280.00 euros

(1) In general, the tax base will consist of the full amount, that is, without deduction of any expenses.

However, in the case of taxpayers residing in another Member State of the European Union and in a State of the European Economic Area in which there is an effective exchange of information (this means adding Iceland, Norway and Liechtenstein), for determining the base taxable, in the case of natural person taxpayers, the expenses provided for in the Personal Income Tax Law may be deducted, provided that the taxpayer proves that they are directly related to the income obtained in Spain and that they have a direct and inseparable economic link. with the activity carried out in Spain.(Back)

When expenses are deducted, a certificate of tax residence in the corresponding State issued by the tax authorities of said State must be attached to the tax return.

(2) Tax rate applicable to 2024 accruals for taxpayers from the EU, Iceland, Norway and Liechtenstein: 19%.

Rest of taxpayers: 24%.(Back)

Do you need information, advice, making an income simulation or help preparing and submitting your income tax return?

Do you want more information? You can read previous posts about personal income tax (IRPF) here and the income tax return, but above all, do not hesitate and contact Moya&Emery, by filling out the form below, if you have any questions or needs in this regard. .

Datos de contacto

O rellena nuestro formulario para ponernos en contacto contigo.