On 27 July, the Council of Ministers approved the new contribution system for the self-employed. The new system will be based on the net income of the self-employed.

It will come into force on 1 January 2023.

It consists of a progressive contribution model that will be deployed over three years, between 2023 and 2025. There will be a transition period of nine years before it becomes definitive in 2032. In order to assess and analyse the development of the new system, a periodic evaluation every three years has been established.

Contribution categories

The new contribution system is designed to allow self-employed workers with lower incomes to reduce their contribution. But only self-employed people who earn less than €22,000 a year will see a reduction in their contribution. For those who generate more income, their contribution will be increased.

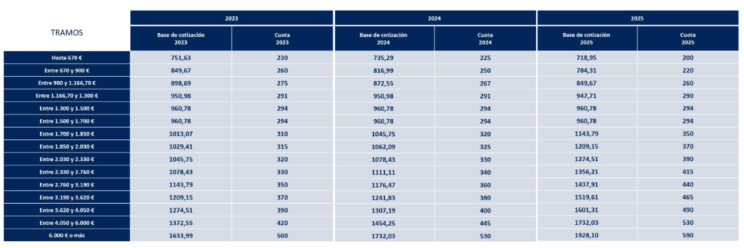

The new system establishes 15 contribution categories into which each self-employed person will have to fall depending on their expected income. Social Security must be notified.

Self-employed contributions after the reform

Tables have been approved in which, depending on the computable net annual income, contributions must be paid for one amount or another.

However, in the case of the corporate self-employed and the collaborating self-employed…

The minimum contribution base in 2023 cannot be less than €1,000.

During 2024 and 2025 the minimum contribution base will be established by the General State Budgets.

From 2025, it will be the one established for contribution group 7 in the General Social Security Regime.

How do I calculate my income?

You have to take into account the net income from your self-employed activity (income – deductible expenses), plus the self-employed contribution and then reduce this amount by 7%.

In the case of the corporate self-employed, the following must be added:

All income in cash or in kind is derived from the company (in which you hold 33% or more of the share capital or 25% in the case of being the Administrator).

Occupational income derived from the activity in that company.

The income that can be obtained from the economic activity itself.

The self-employed contribution must be added to the above amount and 3% must be subtracted from this amount.

How do I choose the contribution rate?

A provision must be made for the net computable income for that calendar year. The estimated amount must be communicated to the Social Security General Treasury through the mobile application: Import@ss.

What happens if I don’t choose the right contribution category?

If your income changes during the year, you can change your contribution base according to your income by applying via the Import@ss mobile application.

You can change your bracket up to six times a year (every two months) depending on your expected increase or decrease in the evolution of your business.

In addition, once the calendar year is over, the General Treasury of the Social Security and the Treasury will cross-reference the data on the income reported with the actual income.

- If you have chosen a lower contribution base than that which corresponds to your income, the Administration will inform you of the amount you will have to pay. The deadline for payment is the last day of the month following the one in which it was notified.

- If you have chosen a higher contribution base, the tax authorities will automatically refund the difference between the two before 31 May of the following year.

Flat rate for the self-employed

Another of the most important new features of the new contribution system is the change in the flat rate. It will now be €80 for the first 12 months of the activity, regardless of the self-employed person’s income.

For the following 12 months, the flat rate will be available to self-employed workers whose net income is below the minimum wage.

What happens if I am already enjoying the €60 flat rate

You can continue to enjoy the €60 flat rate until the maximum period of 12 months has expired.

Bonuses

For caring a minor affected by a serious illness

If you are a beneficiary of the benefit for the care of minors affected by cancer or any other serious illness during the time you receive this benefit, you will be granted a discount of 75% of the self-employed contribution.

For the birth of a son or daughter, adoption, guardianship for the purpose of adoption, fostering and guardianship on returning to self-employment.

Yes, you will be entitled to a bonus of 80% of the contribution for 24 months from the date of returning to self-employment.

Other novelties

Pension plan tax relief

Another novelty is that the self-employed will be able to deduct 10% of their pension plan contributions from their personal income tax.

End of the contribution limit for self-employed workers over 47 years of age.

In 2023, the contribution limit for workers over the age of 47 will disappear, as under the new system, what will be taken into account will be the income to prove that the worker is in the corresponding contribution bracket.

At Moya&Emery we offer accounting and tax services to self-employed for 150€. Do not hesitate to ask us for an appointment.

Or fill in our form and we will contact you.

Moya&Emery, our job is take care of yours.