With the entry into force on January 1, 2023 of Royal Decree-Law 13/2022 of July 26, 2022, a new contribution system is established for self-employed or self-employed workers and protection for cessation of activity is improved.

Below are the main aspects of this new contribution system.

Communication of activities

Those people who start their activity on their own account and process their registration, as of January 1, 2023, must communicate all the activities they carry out as self-employed to the General Treasury of the Social Security.

People who are already registered on January 1, 2023 and carry out more than one activity on their own, will also have to communicate all their activities to the General Treasury of the Social Security.

Both the registration in the Special Regime for Self-Employed Workers, and the communication of these activities, can be done through Importass, Portal of the General Treasury of the Social Security.

Quotation based on the returns obtained

All self-employed persons will contribute to Social Security based on their annual net income, obtained in the exercise of all their economic, business or professional activities. Persons who are part of a religious institution belonging to the Catholic Church will not be quoted for income.

For the purposes of determining the contribution base, all the net income obtained in the calendar year, in the exercise of their different professional or economic activities, will be taken into account, regardless of whether they are carried out individually or as partners or members of any entity, with or without legal personality, as long as they should not be registered as employees or assimilated to them. The computable net income of each of the activities carried out will be calculated in accordance with the provisions of the IRPF rules and with some particularities depending on the group to which they belong. For more information, see How do I calculate my returns? .

The resulting amount will be deducted 7 percent as general expenses, except in cases where the self-employed worker meets the following characteristics, where the percentage will be 3 percent:

- Administrator of capitalist mercantile companies whose participation is greater than or equal to 25 per cent.

- Partner in a capitalist commercial company with a participation greater than or equal to 33 per cent.

For the application of the indicated percentage of 3 percent, it will be sufficient to have appeared ninety days in registration in this special regime, during the period to be regularized, in any of the cases mentioned above.

Based on the monthly average of these annual net returns, the contribution base will be selected that will determine the fee to be paid.

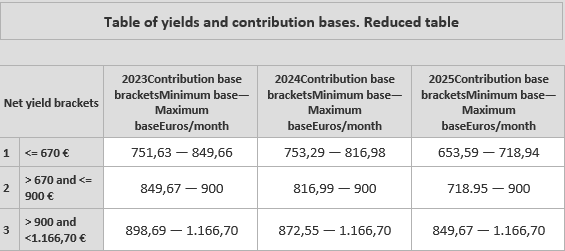

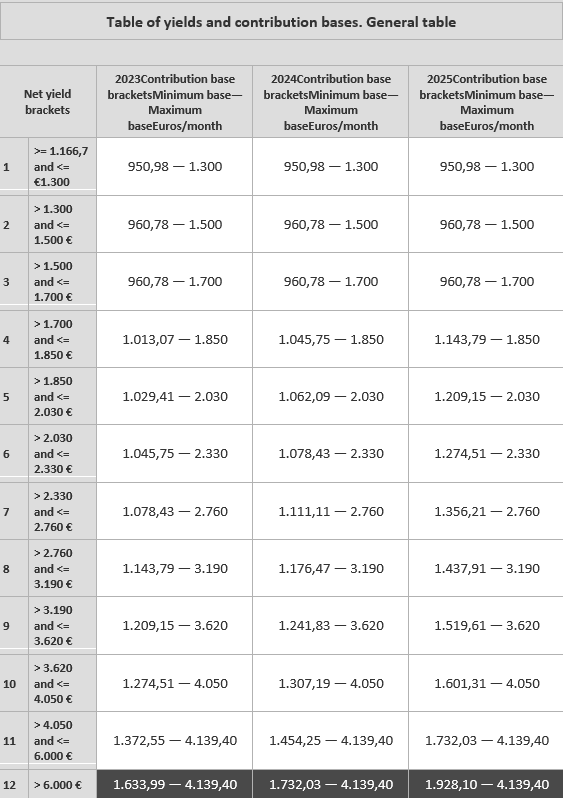

Annually, the General State Budget Law will establish a general table and a reduced table of contribution bases that will be divided into consecutive tranches of monthly net income amounts to which will be assigned, for each tranche, maximum and minimum monthly contribution bases. In the following table you can consult these new income brackets and their corresponding contribution bases for the next three years:

As of January 1, 2023, self-employed workers will be able to declare their expected income through the services that will be available in Importass, the portal of the General Treasury of the Social Security for online services and procedures.

For the self-employed who register from this date, this information will be requested in the registration process that is carried out through Importass.

In the event that the self-employed person is already registered, they may modify their contribution base to adjust it to the forecast on the monthly average of their annual net income through the Contribution and Yield Base service.

Self-employed workers who, on 31/12/2022, were contributing for a contribution base higher than that which would correspond to them due to their estimated income, may maintain this contribution base in 2023, even if their income determines the application of a lower contribution base.

In Importass a simulator is available to calculate the quota based on the expected performances.

Possibility to change the contribution base if the yields vary

If a variation in net returns is expected throughout 2023, it will be possible to select a new contribution base every two months and, therefore, a new quota adapted to them with a maximum of six changes per year. This modification will be effective on the following dates:

- March 1, 2023, if the request is made between January 1 and the last calendar day of February.

- 1 May 2023, if the application is made between 1 March and 30 April.

- 1 July 2023, if the application is made between 1 May and 30 June.

- 1 September 2023, if the request is made between 1 July and 31 August.

- 1 November 2023, if the request is made between 1 September and 31 October.

- January 1, 2024, if the request is made between November 1 and December 31

Regularization of Social Security contributions

The monthly bases chosen each year will be provisional, until the annual regularization of the contribution is carried out.

At the end of the calendar year, the Tax Administration will provide the Treasury with information on the actual annual income received. If the quota chosen during the year is lower than that associated with the income communicated by the corresponding Tax Administration, the worker will be notified of the amount of the difference. This amount must be paid before the last day of the month following that in which the notification was received with the result of the adjustment.

If, on the other hand, the contribution is higher than that corresponding to the maximum base of the tranche in which the income is included, the Treasury will proceed to reimburse the difference before April 30 of the year following that in which the corresponding Tax Administration has communicated the computable income.

Flat rate for new freelancers

During the period 2023-2025, people who cause initial registration in the Self-Employed Regime may request the application of a reduced fee (flat rate) of 80 euros per month during the first 12 months of activity. The request will be made at the time of processing.

Self-employed persons who have not been registered in the two years immediately prior to the effective date of the new registration, or three years, if they have previously enjoyed this deduction, may benefit from these conditions.

After these first twelve months, a reduced quota may also be applied during the following twelve months, to those self-employed workers who foresee that their annual net economic returns will be lower than the annual minimum interprofessional wage corresponding to that period and so request in the service that will be enabled in Importass.

In addition, self-employed people with a disability equal to or greater than 33 percent, victim of gender violence or victim of terrorism, may request the application, at the time of discharge, of a reduced fee of 80 euros during the first 24 months.

Likewise, at the end of this period, if their expected net performance is equal to or less than the Minimum Interprofessional Wage, they may request, through the service that will be enabled in Importass, the application of this reduced fee during the following 36 months, amounting to 160 euros.

All requests for extension must be accompanied by a statement that the net income expected to be obtained will be lower than the minimum professional wage in force.

The reductions in the contribution provided for in the previous paragraphs will not be applicable to the relatives of self-employed workers by consanguinity or affinity up to and including the second degree and, where appropriate, by adoption, who are incorporated into the Special Social Security Regime for Self-Employed or Self-Employed Workers.

Self-employed workers who enjoy these benefits may at any time expressly waive their application with effect from the first day of the month following the communication of the corresponding resignation. This request can also be made through the service that will be enabled in Importass.

Self-employed workers who on December 31, 2022 were beneficiaries of the old flat rate, will continue to enjoy it, until the maximum period established is exhausted, under the same conditions.

News in the benefits applicable to the contribution for the self-employed in 2023

- Bonus in the contribution for self-employed for the care of a child affected by a serious illness

The self-employed persons benefiting from the benefit for the care of minors affected by cancer or another serious illness will be entitled, during the period in which they receive said benefit, to a bonus of 75 percent of the quota for common contingencies, resulting from applying to the average base of the twelve months prior to the date on which this bonus begins, the contribution rate for common contingencies, excluding that corresponding to IT derived from common contingencies.

If the worker has been continuously registered in the Self-Employed Regime for less than twelve months, for the calculation of the average contribution base, the last date of registration will be taken into account, the result of which is obtained by dividing the sum of the contribution bases by the number of days in which he has been continuously registered, and the amount obtained is multiplied by thirty.

- Bonus for self-employed workers for reinstatement to their activity

Self-employed workers who cease their activity due to the birth of a child, adoption, guardianship for the purposes of adoption, foster care and guardianship and wish to return to self-employment within two years of the date of cessation, will be entitled to a bonus, during the 24 months immediately following the date of their return to work, of 80 per cent of the quota for common contingencies, resulting from applying to the average base of the twelve months prior to the date on which they ceased their activity, the contribution rate for common contingencies, excluding that corresponding to IT derived from common contingencies.

CONTACT DETAILS

Or fill in our form and we will contact you.

VISIT OUR OFFICES IN PALMA OR CALVIA

C/Pere Dezcallar i Net n11 (Palma)

C/Còrdova n5 (Son Caliu)